Get ready for a real estate rollercoaster in 2024! This year is your golden ticket to a new home adventure.

Just like a blockbuster sequel, 2024 is bringing us more of the good stuff. Following the trend from 2022, Red Deer and the surrounding area rocked low inventory levels, strong sale prices, and even some exciting price growth in certain cases. The real estate stage was set, especially for homes above $500,000, probably doing the cha-cha with the higher cost of borrowing.

But hold your horses – 2024 is kicking off with rate holds, and the forecast? The Bank of Canada is expected to sprinkle some rate declines on us. Cue the confetti!

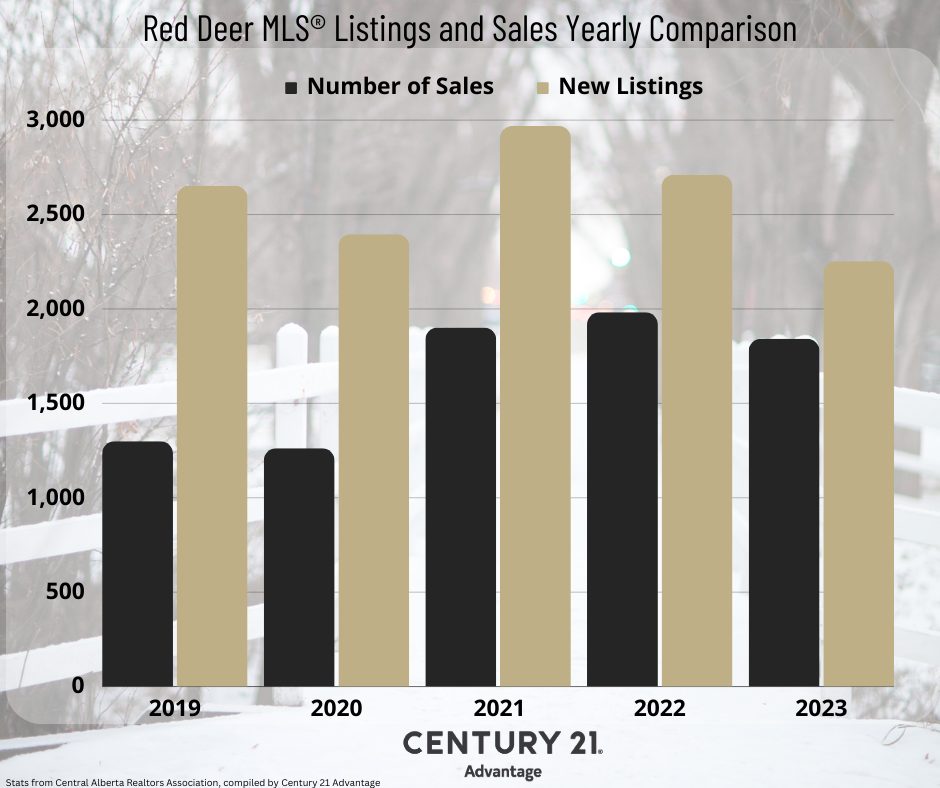

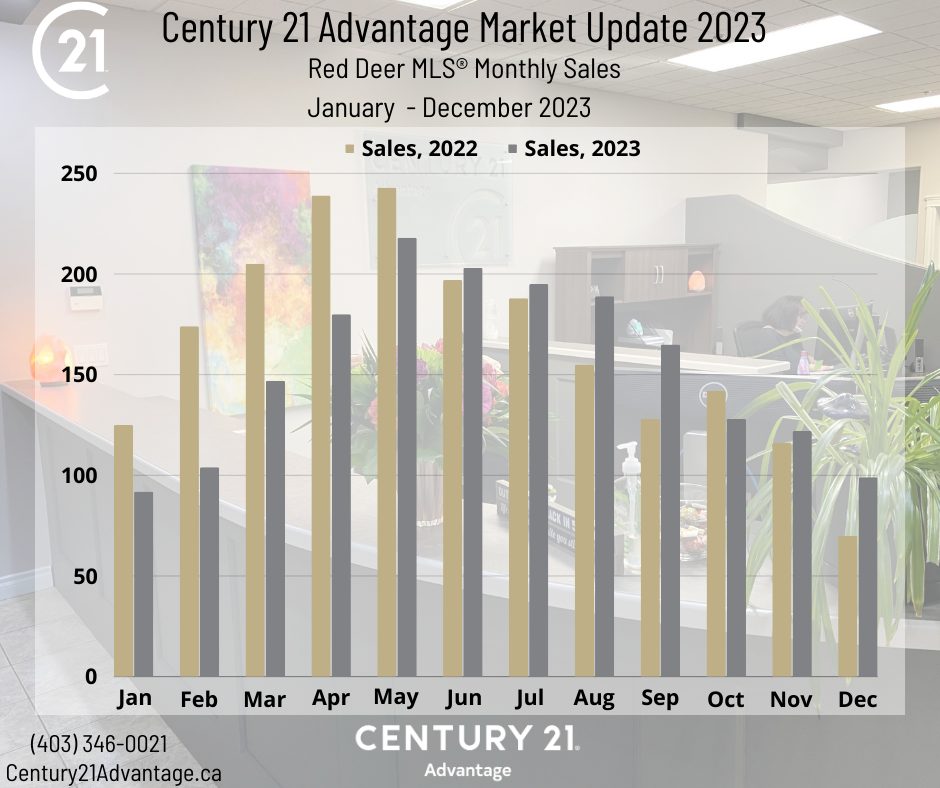

Did you hear the buzz? In 2023, Red Deer real estate sales stole the spotlight with the 4th highest sales volume in the last decade! That's 1,842 residential MLS® sales, beating out 2022 and 2021. We even had to dust off the archives to 2014 for 2,026 sales in Red Deer.

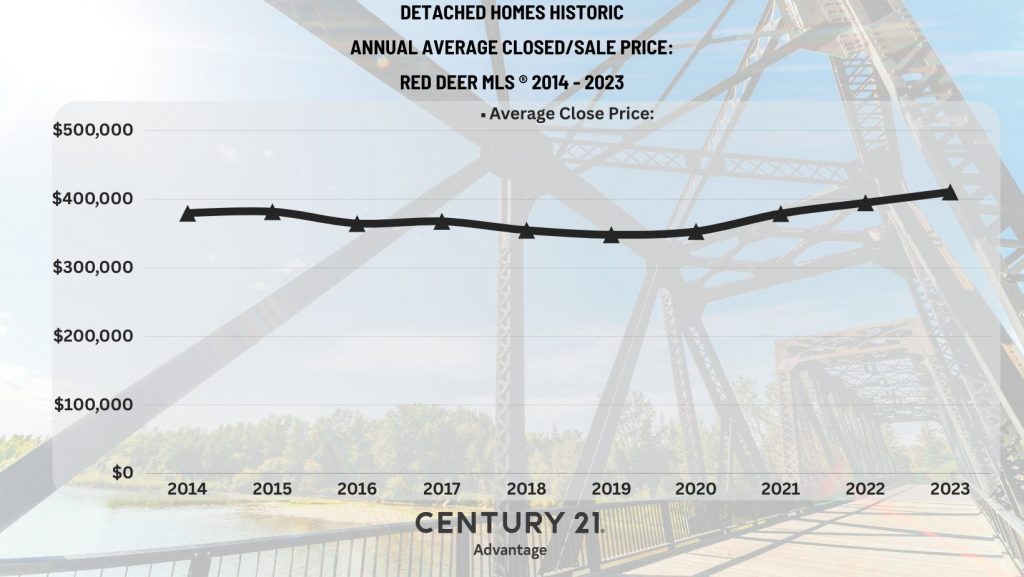

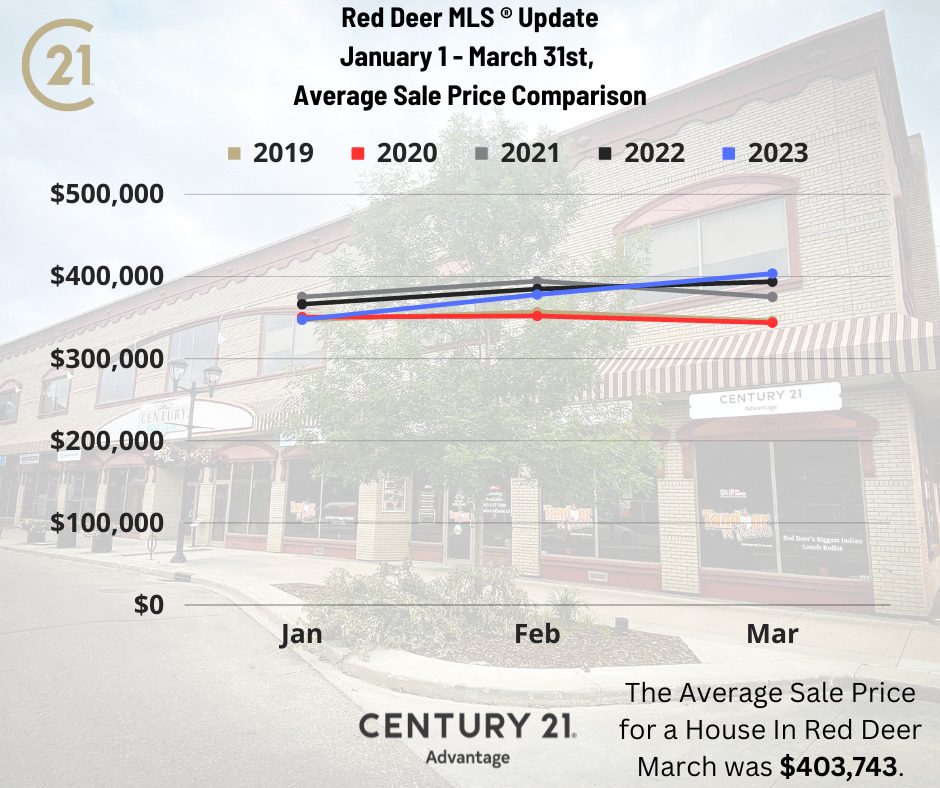

The closing price average for 2023? A jaw-dropping $340,795, the highest in the past 10 years! Talk about a crescendo! Average closing/sale price for a house in Red Deer? A cool $410,602, soaring past the previous 9 years. Ready to ride the wave of growth? If you're thinking of selling, now's your chance to shine.

Check out this snapshot of Red Deer's historic average closing prices!

**Real Estate Supply And Demand Dance:**

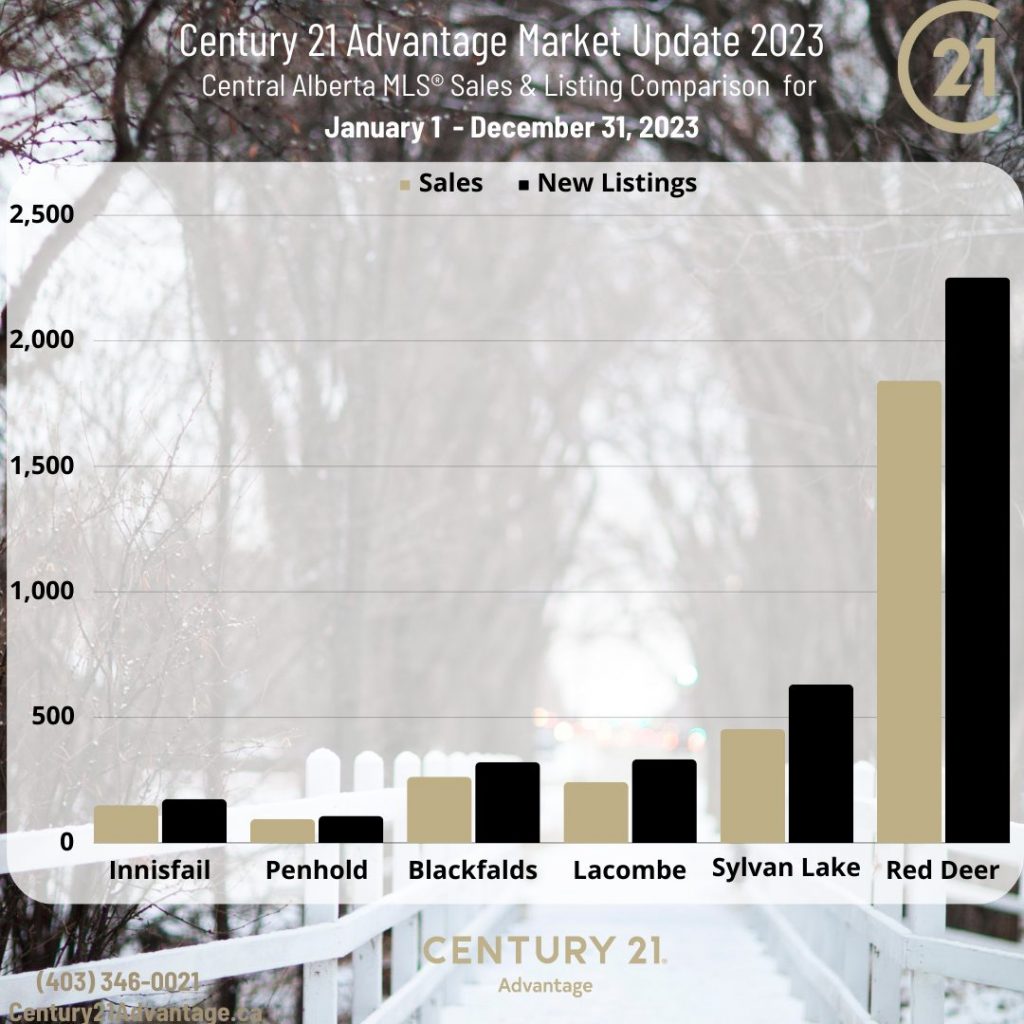

2023 MLS Sales & Listings in Red Deer AB

Picture this: Red Deer and neighbouring areas grooving to the same beat. Most communities mirror sales with new listings. It's a tight supply and demand dance, and sellers are the stars. Buyers are feeling the pressure to find their dream home, with time becoming a premium commodity. In 2023, we had a surplus of tenant-occupied homes for sale. The market was a playground for quirky or tired homes, attracting landlords looking to switch up their portfolios.

Behold the yearly sales chart!

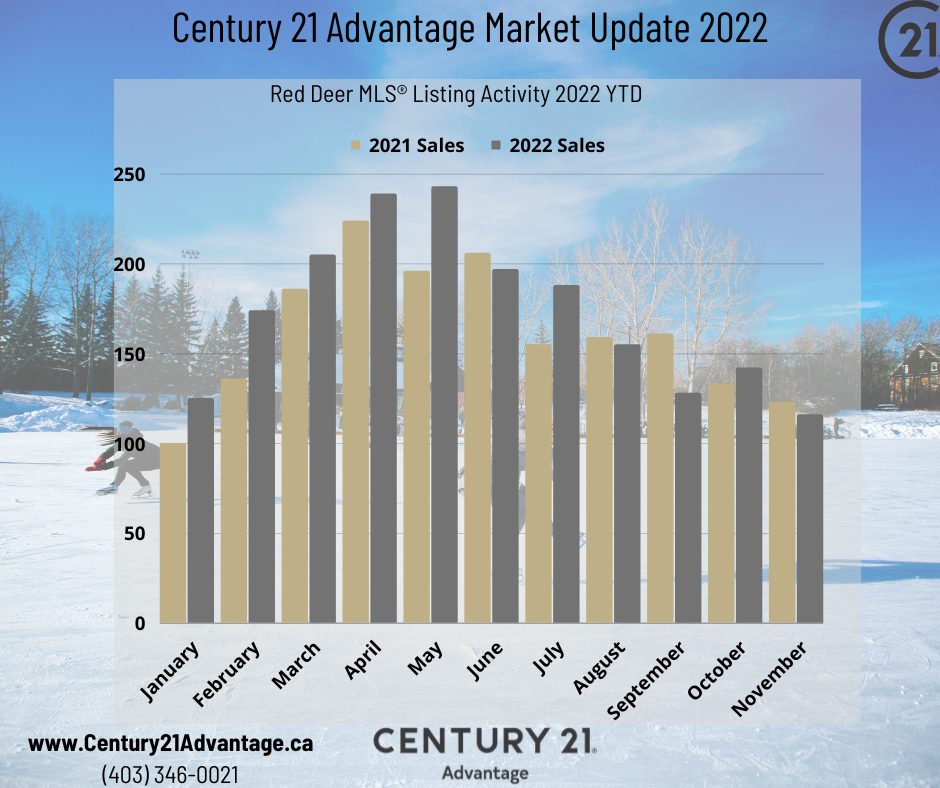

2023 was a bit softer compared to the blockbuster 2022, thanks to the rate increases tapping the brakes on the real estate market.

Now, let's talk interest rates. The Bank of Canada is playing DJ with these tunes:

| Date* | Target (%) | Change (%) |

| December 6, 2023 | 5 | --- |

| October 25, 2023 | 5 | --- |

| September 6, 2023 | 5 | --- |

| July 12, 2023 | 5 | 0.25 |

| June 7, 2023 | 4.75 | 0.25 |

| April 12, 2023 | 4.5 | --- |

| March 8, 2023 | 4.5 | --- |

| January 25, 2023 | 4.5 | 0.25 |

| December 7, 2022 | 4.25 | 0.5 |

| October 26, 2022 | 3.75 | 0.5 |

| September 7, 2022 | 3.25 | 0.75 |

| July 13, 2022 | 2.5 | 1 |

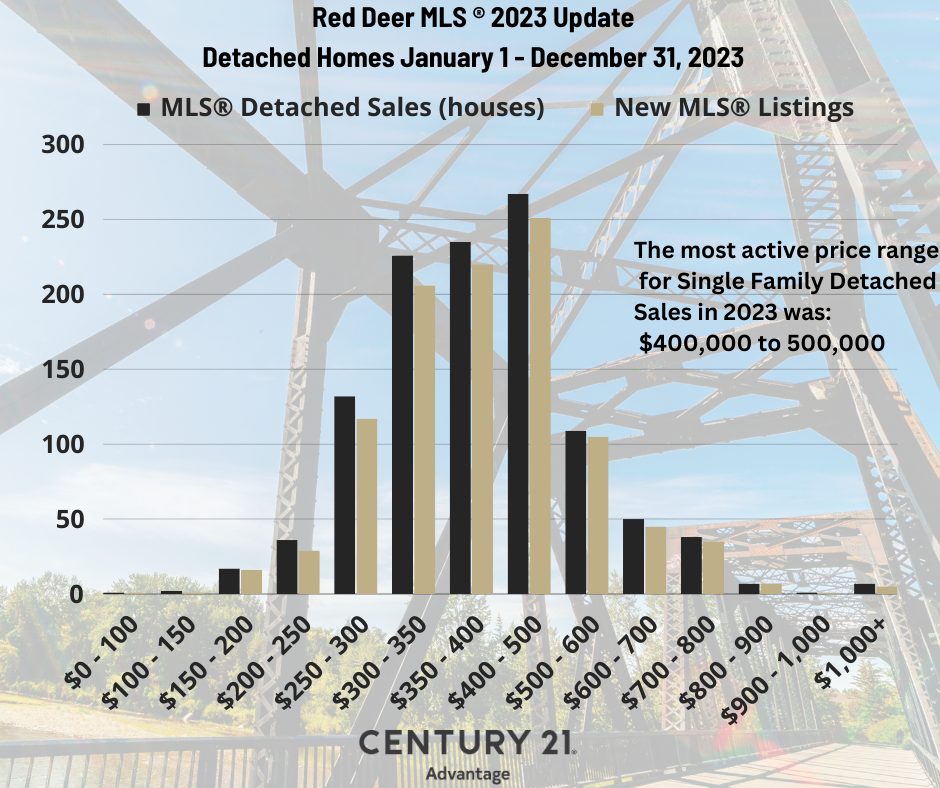

**Unlocking the Secrets of Sales by Price Range:**

Hold on to your hats – interest rate hikes put on a dazzling show for house sales above $500,000!

[Behold the magic in this chart!]

**Riding the Seasonal Real Estate Wave:**

2024 is like the summer blockbuster of real estate. Sales followed the 2022 script but cranked up the excitement late in the season. The usual snooze fest of December and January became the calm before the storm – moving in -20º or -30ºC isn't everyone's cup of tea. Throw in holiday presents and family visits, and these months are the real estate siesta.

Now that lending rates have hit a pause and might even take a dip in the spring, are you ready to make your move in 2024? Buying or selling, this year's real estate soundtrack is waiting for you!

Are you ready to make a move in 2024?

Contact us for a free no-obligation real estate consultation. We're happy to schedule an appointment for market evaluation or discuss the home of your dreams.

Enter to win FREE Pass to the Expo

Century 21 Advantage is proud to be a supporter of the Healthy Living Expo 2024.

Join us on January 27, 2024, at the Harvest Centre in Westerner Park between 10 am & 5 pm for a fun-filled and informative outing in support of healthy living.

Fun healthy lifestyle facts about living in Red Deer.

- Red Deer has 18 Neighbourhood Associations that have activity centres. These are used as skate shacks, local fitness classes and more. Learn about them here.

- Red Deer has 76 outdoor skating surfaces. The ice surface is maintained throughout the winter season weather permitting.

- The City of Red Deer has 18 different maps for a variety of outdoor activities. From the amenities at Great Chief Park, Oxbow Dog Park Map, and Victoria Park Disc Golf Map, to trail uses such as Bike Routes, and Cross country ski trails. Check them all out here.

In addition to utilizing our outdoor spaces and trails, Red Deer has a Tennis club with a year-round Tennis Dome downtown at the Rec Centre area. If you have heard about and want to try Pickleball, the city has 20 dedicated outdoor courts in the NE corner of the City south of Evergreen.

Sports options are plentiful in Red Deer as are the fitness studios, Yoga, and all kinds of fitness options. Whether you want to live near the Collicut or Rec Centre for a more active lifestyle or in a home more convenient to Pickleball or Golf. We have you covered.

Want to check out the Healthy Living Expo?

We're giving away Tickets. Enter here for a Family pass to attend the Healthy Living Expo on January 27, 2024, at the Harvest Centre in Westerner Park. Please fill out the form below or click here to open the form in a new window.

Is now the best time to buy real estate?

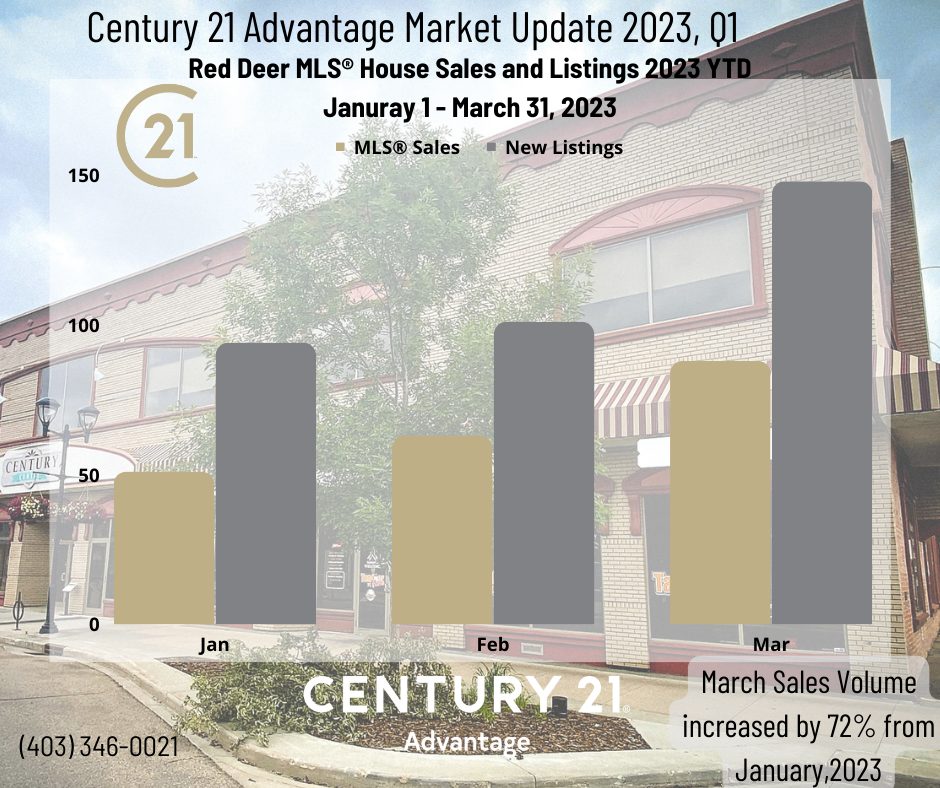

Here are a few key performance indicators that help answer that question. Here is a look at the "house" market or properties defined as "single-family detached".

The monthly market is showing characteristics of being balanced and in some cases a "seller's" market.

| Month | MLS Sales | New Listings | Ratio |

| Jan | 51 | 94 | 54.26% |

| Feb | 63 | 101 | 62.38% |

| Mar | 88 | 148 | 59.46% |

| 202 | 343 | 58.89% |

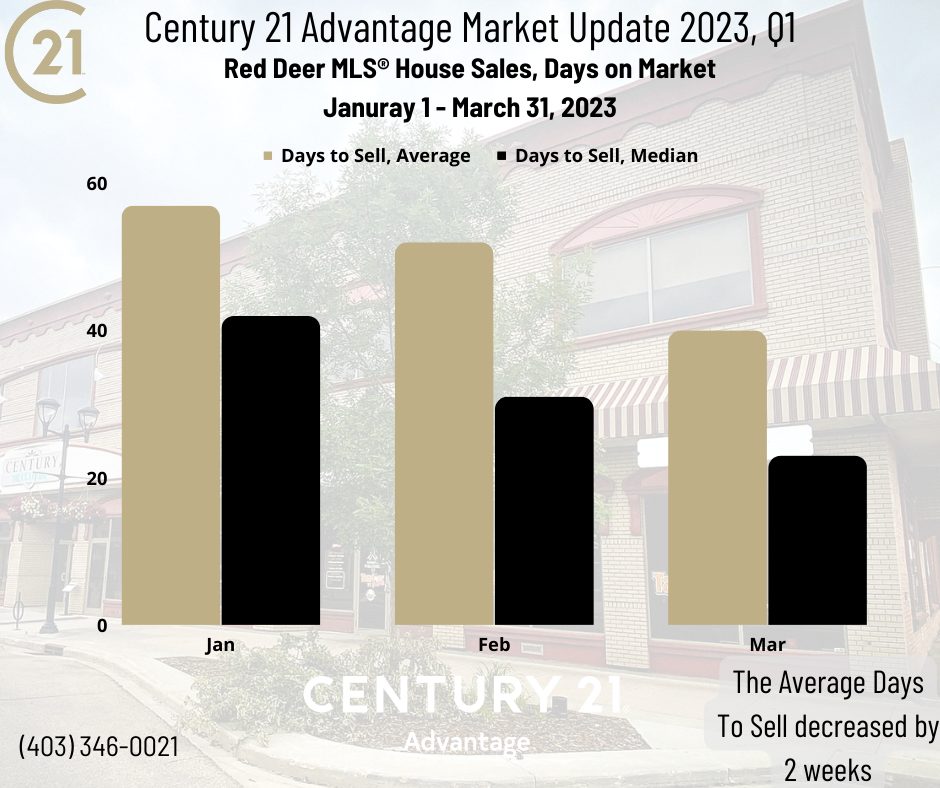

The Red Deer and area real estate market is said to be "balanced when the demand, or sales, is between 45 - 60% of the new listing volume. When the demand is consistently above 60%, there is little carry-over of unsold listings month to month. This can also be deflected in the Days on Market or Days to Sell numbers.

The average days to sell for Red Deer real estate have been declining with a stronger real estate market. The median days to sell for the Month of March was only 23 days!

This means 50% of the homes have a value smaller or equal to the median and 50% of the homes have a value higher or equal to the median.

Despite increases in the interest rates for mortgages, home prices remain strong, and have some modest growth compared to previous years. The average sale price of a house in Red Deer, in March 2023, rose to $403,743. An increase of 2.5% over 2022 levels.

The bottom line is, the best time to buy a house is up to you. as the best time to buy a house will vary for every prospective buyer.

However, if you're concerned about a declining market, that certainly doesn't appear to be the case. The real estate market in Red Deer is resilient.

Enter to win FREE Pass to the Expo

Century 21 Advantage is proud to be a supporter of the Healthy Living Expo 2023.

Join us on January 21, at the Harvest Centre in Westerner Park between 10 am & 5 pm for a fun-filled and informative outing in support of healthy living.

Fun healthy lifestyle facts about living in Red Deer.

- Red Deer has 18 Neighbourhood Associations that have activity centres. These are used as skate shacks, local fitness classes and more. Learn about them here.

- Red Deer has 76 outdoor skating surfaces. The ice surface is maintained throughout the winter season weather permitting.

- The City of Red Deer has 18 different maps for a variety of outdoor activities. From the amenities at Great Chief Park, Oxbow Dog Park Map, Victoria park disc Golf Map, to trail uses such as Bike Routes, and Cross country ski trails. Check them all out here.

In addition to utilizing our outdoor spaces and trails, Red Deer has a Tennis club with year-round Tennis Dome downtown at the Rec Centre area. If you have heard about and want to try Pickleball, the city has 20 dedicated outdoor courts in the NE corner of the City south of Evergreen.

Sports options are plentiful in Red Deer as are the fitness studios, Yoga, and all kinds of fitness options. Whether you want to live near the Collicut or Rec Centre for a more active lifestyle or in a home more convenient to Pickleball or Golf. We have you covered.

Want to check out the Healthy Living Expo?

We're giving away Tickets. Enter here for a Family pass to attend the Healthy Living Expo on January 21, 2023, at the Harvest Centre in Westerner Park. Please fill out the form below or click here to open the form in a new window.

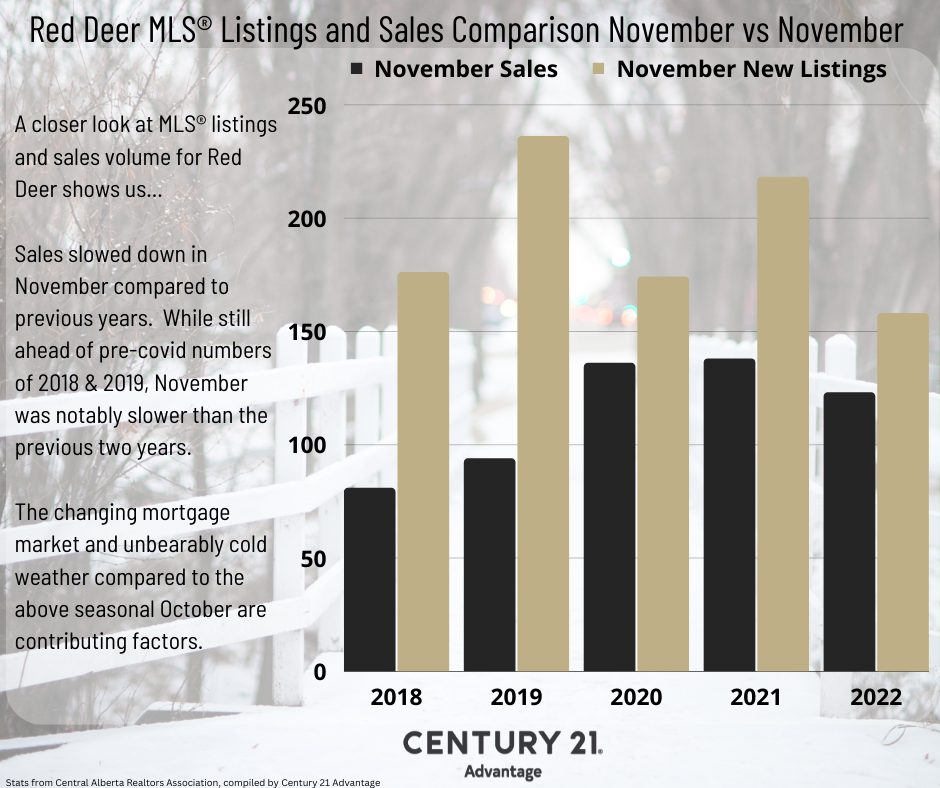

November 2022, Red Deer Real Estate Stats Review

A closer look at MLS® listings and sales volume for Red Deer shows us...

Sales slowed down in November compared to previous years. While still ahead of pre-covid numbers of 2018 & 2019, November was notably slower than the previous two years.

The changing mortgage market and unbearably cold weather compared to the above seasonal October are contributing factors.

Bank Rate Increases and Their Impact on the Real Estate Market

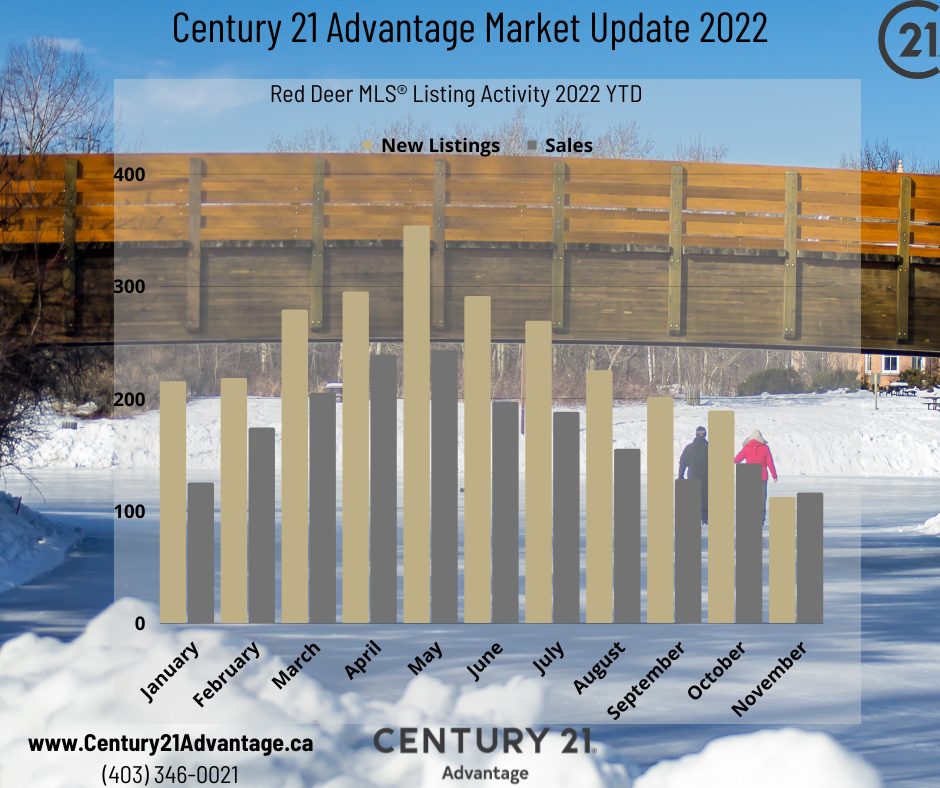

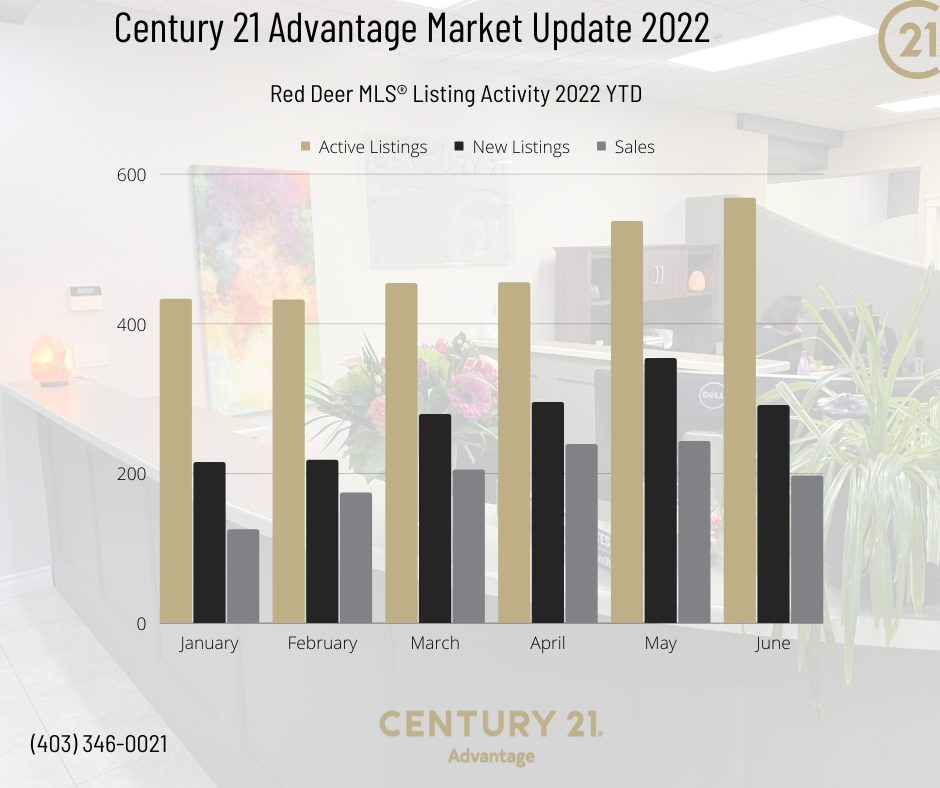

The seasonal trend for 2022 shows a strong spring market with sales and listing volume peaking in May. Do the results in the market reflect the interest rate increases announced by the Bank of Canada?

- April 13, 2022, The Bank of Canada increased its target for the overnight rate to 1%, with the Bank Rate at 1¼%. Effective April 25.

- On June 1, 2022, The Bank of Canada increased its target for the overnight rate to 1½%, with the Bank Rate at 1¾%.

- July 13, 2022, The Bank of Canada increased its target for the overnight rate to 2½%.

- September 7, 2022, The Bank of Canada increased its target for the overnight rate to 3¼%.

- On October 26, 2022, The Bank of Canada increased its target for the overnight rate to 3¾%.

- December 7, 2022, The Bank of Canada today increased its target for the overnight rate to 4¼%, with the Bank Rate at 4½%.

The next scheduled date for announcing the overnight rate target is January 25, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR at the same time.

The Bank of Canada's rate increases has certainly had an impact. You can see the rush of deals in May to take advantage of low rates, and the volume decline with each jump in rates.

We're expecting this change will have a cooling off and adoption of the new rates for budgets. The deciding factor has always been overall affordability compared to renting.

It's hard to believe that the last time rates were at this level was 2008/2009.

source: tradingeconomics.com

Red Deer Lights the Nights is a series of activities over several weeks. Through December 17, fun and festive activities are taking place downtown and throughout the city.

Schedule of events

Below is a list of the fun events and activities that make up Red Deer Lights the Nights.

Activity

- North Pole Plaza Party - December 1

- Neighbourhood light contests December 1

- Seasons Treatings photo contest December 1 - 24

December 8

- Twinkle Tour 5 - 8 p.m. Starting at Ross Street Patio

- Free Hot Chocolate in City Hall Park 5 - 6:30 p.m. City Hall Park

- Late Night Shopping Until 8 p.m. (or later) Downtown and Capstone

- Winter Market December 9 & 10 3 - 7 p.m.

12 - 5 p.m. Millennium Centre

4909 49 Street - Frozen Photos on Frost Street Patio December 15 4 - 7 p.m. Ross Street Patio

- Free Hot Chocolate & Roaming Elves December 15 5 - 6:30 p.m. City Hall Park

Red Deer Christmas Light Tour

For more information please visit the Downtown Red Deer Business Association website: https://downtownreddeer.com/red-deer-lights-the-night/

DOWNLOAD a PDF MAP of all 2022 Routes here.

https://www.reddeer.ca/media/reddeerca/recreation-and-culture/events/SantaBus_Map_AllRoutes.pdf

Why Move to Red Deer? - The Red Deer Rebels

Are you a hockey fan? The Red Deer Rebels are a must to see whether you love hockey or are new to the sport. The atmosphere of Live hockey is a real treat. The Peavey Mart Centrium has great vibes and amenities.

The Red Deer Rebels Upcoming Games

- Nov25, 2022

- Red Deer Rebels vs Medicine Hat Tigers

- Nov26, 2022

- Red Deer Rebels vs Prince Albert Raiders

- Dec02, 2022

- Red Deer Rebels vs Saskatoon Blades

- Dec03, 2022

- Red Deer Rebels vs Moose Jaw Warriors

- Dec07, 2022

- Red Deer Rebels vs Medicine Hat Tigers

- Dec09, 2022

- Red Deer Rebels vs Edmonton Oil Kings

See the full schedule of the Red Deer Rebels here.

What is special about the Red Deer Rebels?

The Peavey Mart Centrium opened in 1991 it has hosted the CFR, World Junior Hockey Games, The Scotties Tournament of Hearts, and major recording artists such as Bryan Adams. With over 7,000 seats the Peavey Mart Centrium has some amazing box seats and a well-appointed concourse.

Currently, in the 2022/23 season, the Rebels are off to a great start sitting 2nd in their division. They have had great success on the ice, not just this season but in years past. Fans appreciate seeing the young talent grow and move on to the NHL Some notable Rebel alumni include Ryan Nugent-Hopkins, Dion Phaneuf, Colin Fraser and head coach Brent Sutter.

The Peavey Mart Centrium is one of many facilities at Red Deer's Westerner Park.

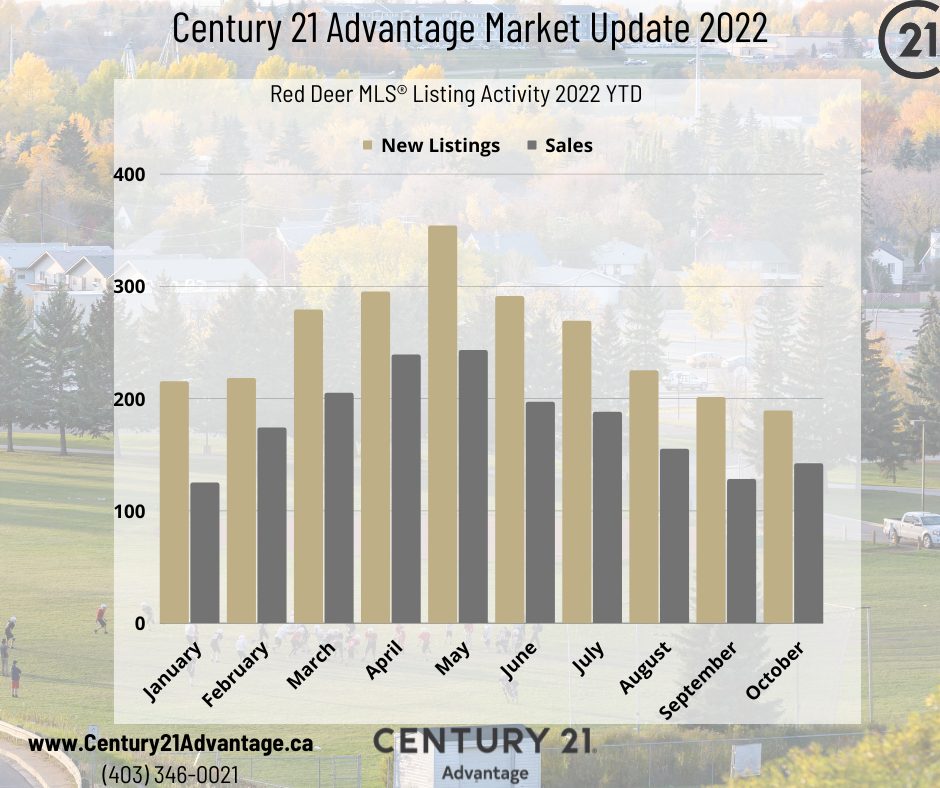

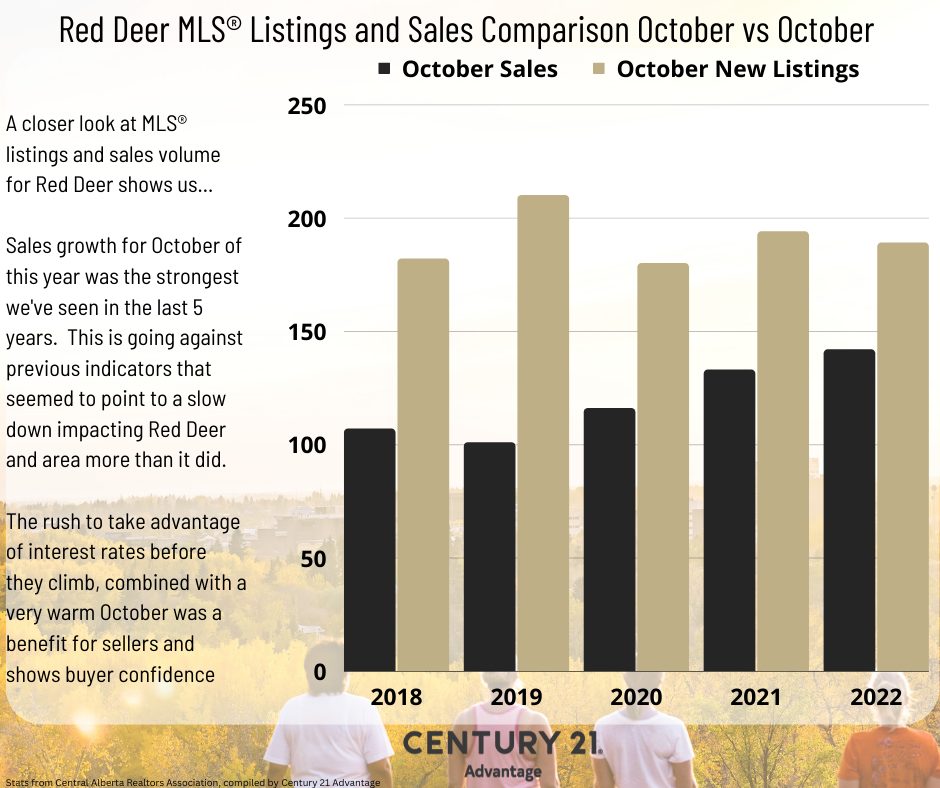

October 2022 Red Deer MLS® Market Update

The Red Deer real estate market has certainly been experiencing a little bit of everything thing year. From a very robust spring to several interest rate increases the impacts of which we expected to see.

Upon first glance, the above chart looks "normal". It has the usual seasonal trend with a rise and fall in listings and sales volumes. The difference was actually in October. Where the sales volume increased over September.

This bump-up in sales activity goes against the expectations that the rising interest rates would deter more buyers. It could be the announcement created a bit of a rush. This combined with above seasonal temperatures throughout October, buyers were out in full force finding the right home before those rates increased again and before the snow flys.

A look at the sales of the last few years, the sales volume for October 2022, exceeded the previous years. The increase in sales combined with the lower listing volume creates a more "balanced" market dynamic. This is positive news for sellers and shows buyer confidence.

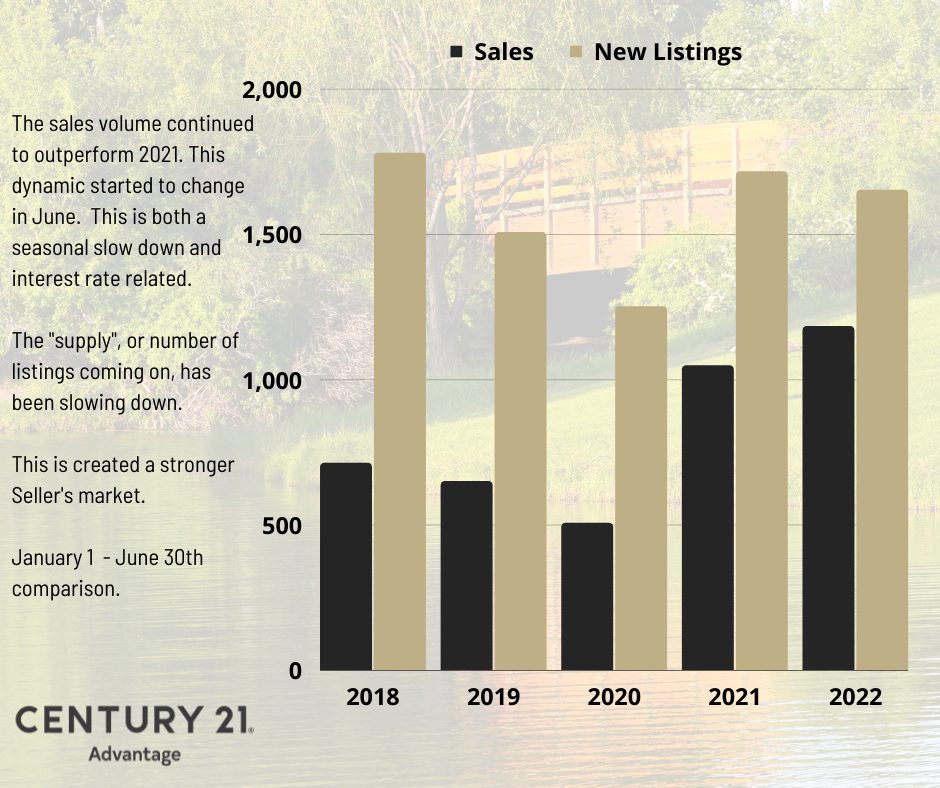

First Half of 2022, Market Update

How's the Market? Are things still crazy with the interest rates? If you have these questions, you're not alone. We get asked these all the time. We're happy to answer how the local market is for your home.

Upon closer look at the Supply & Demand this year, the times are a-changing.

The local real estate market got "HOT" this year. The sales volume increased to its peak in April & May. Followed by an increase in supply, as the seller's answered the call and demand started to subside.

A number of variables influence supply & demand. Weather, the Economy, jobs and the migration of workers to fill those jobs, and interest rates. The interest rates definitely impact buying budgets.

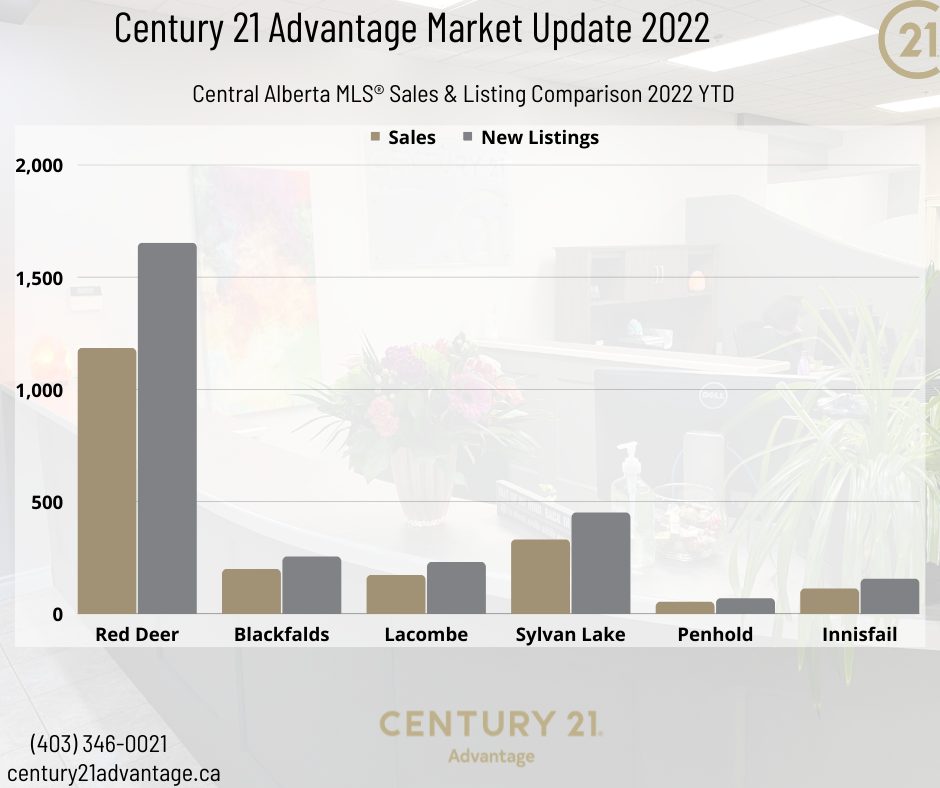

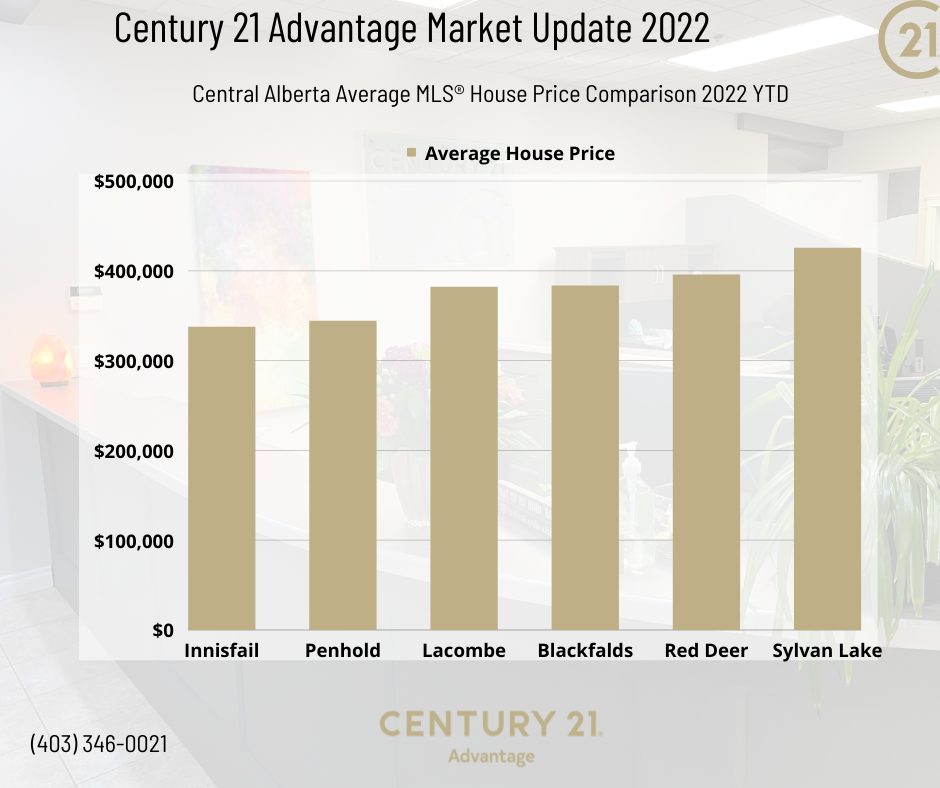

Each community in Central Alberta has benefited from the improved economy. Reviewing our slides below you'll note some similarities as well as some unique differences. See comparisons below for January 1 - June 30, 2022:

Red Deer led the way with sales and listings as one would expect due to the population size of the community

Red Deer reported 1,183 sales, and 1,652 new listings (1,183/1,652) compared to:

- Blackfalds 199/254

- Lacombe 173/230

- Sylvan Lake 331/450

- Penhold 53/69

- Innisfail 112/155

Affordability of housing remains highest in Innisfail with the average house price reported as $337,286.

Meanwhile, Sylvan Lake has the highest average sale price with $425,460 for a home.

- Innisfail $337,286

- Penhold $343,908

- Lacombe $381,850

- Blackfalds $395,411

- Red Deer $395,411

- Sylvan Lake $425,460

Welcome to June 2022!

Sun is shining, it feels like summer is here, and for sale, signs have been popping up as fast as dandelions out there.

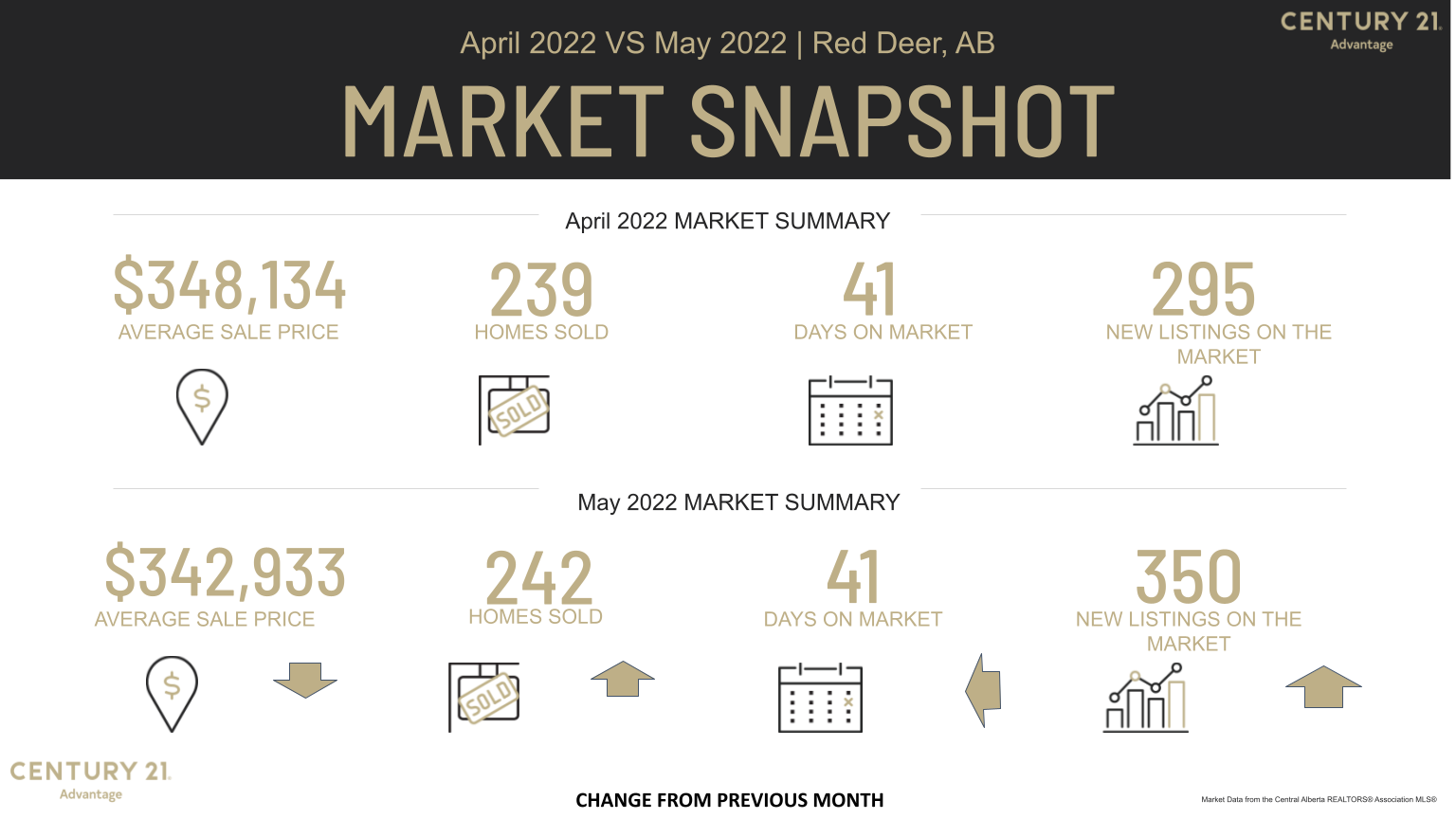

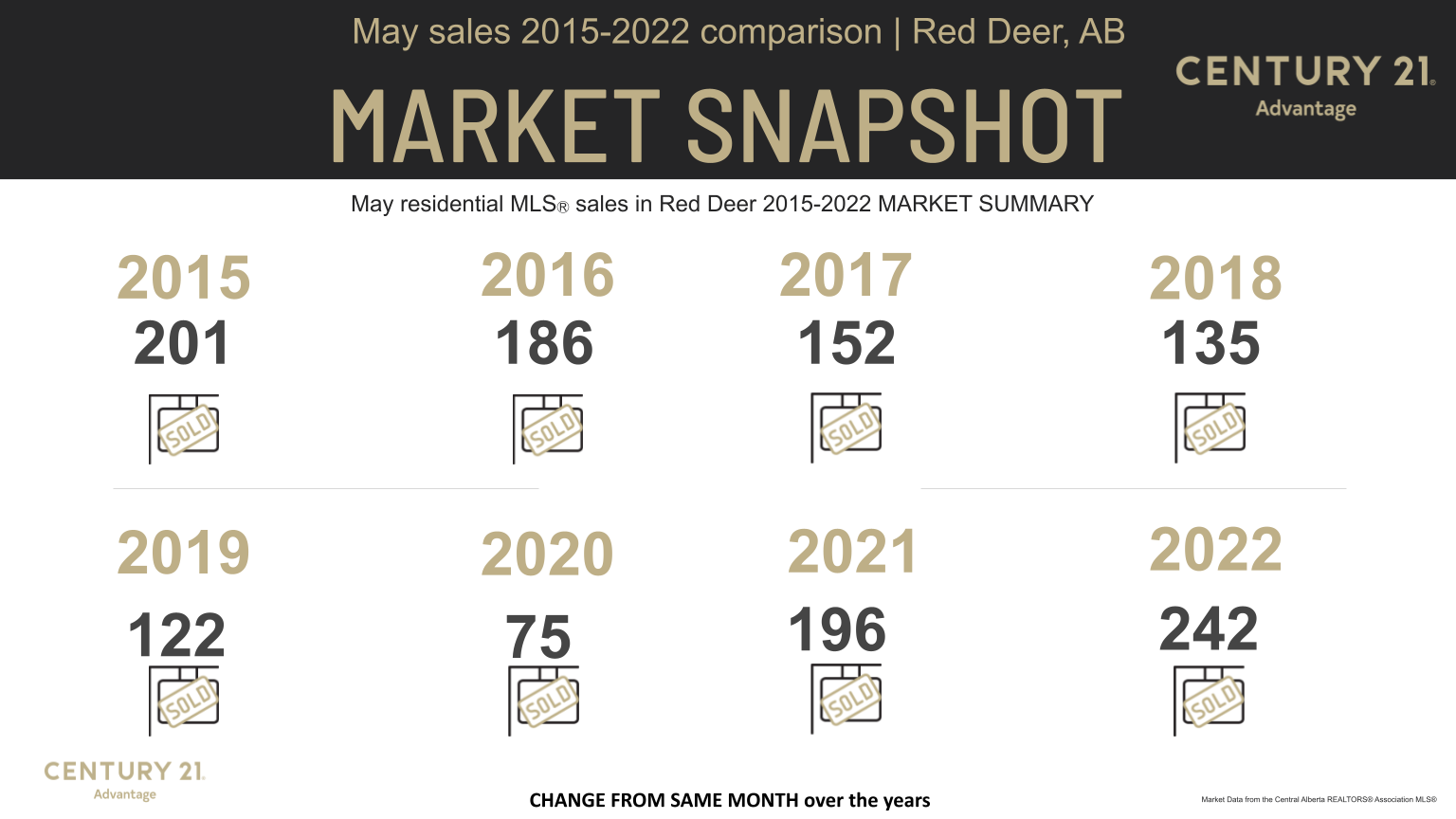

May sales volume just squeaked past the high level we saw in April this year. 242 residential sales were reported in May 2022 on our MLS system. For Red Deer real estate this is a strong volume. We anticipate that sales volume would slump more due to the jump in interest rates. Add to that the Stanley Cup battle of Alberta, yes believe it or not very few people were wanting to do much of anything during game time than drink beer, eat chips and yell at the referees.

The number of New Listings on the market rose compared to April as well as last year. Indicating a shift in the supply and demand equation, moving the scales toward a more BALANCED marketplace.

What is the Significance of 242?

Not only is the Red Deer real estate monthly MLS sales volume for May 2022 higher than April this year. It is the 4th highest monthly sales volume of any month since:

- May 2014 - 249 sales reported

- May 2007 - 247 sales reported

- April 2007 245 sales reported

May 2022 reportedly 242 Sales as of June 1 (**note there may be MLS database adjustments of a unit or two).

Have we hit the peak volume for the year? Probably. If you want to sell this summer, it would be my recommendation to fine-tune your value package. Meaning you may need to adjust the price, paint the trim, fertilize the lawn, clean the window etc... In short, improve the bang for the buck for your home. The luxury of testing the waters has started to pass for more price ranges.

Fortunately for you, we have agents that have been working here in Red Deer for over 20 years. They have worked through peaks and valleys with sales volumes, and know how to adjust to meet the current trends. Call us, we have a history in Red Deer as a company (since 1911) longer than any other real estate firm.