November 2022, Red Deer Real Estate Stats Review

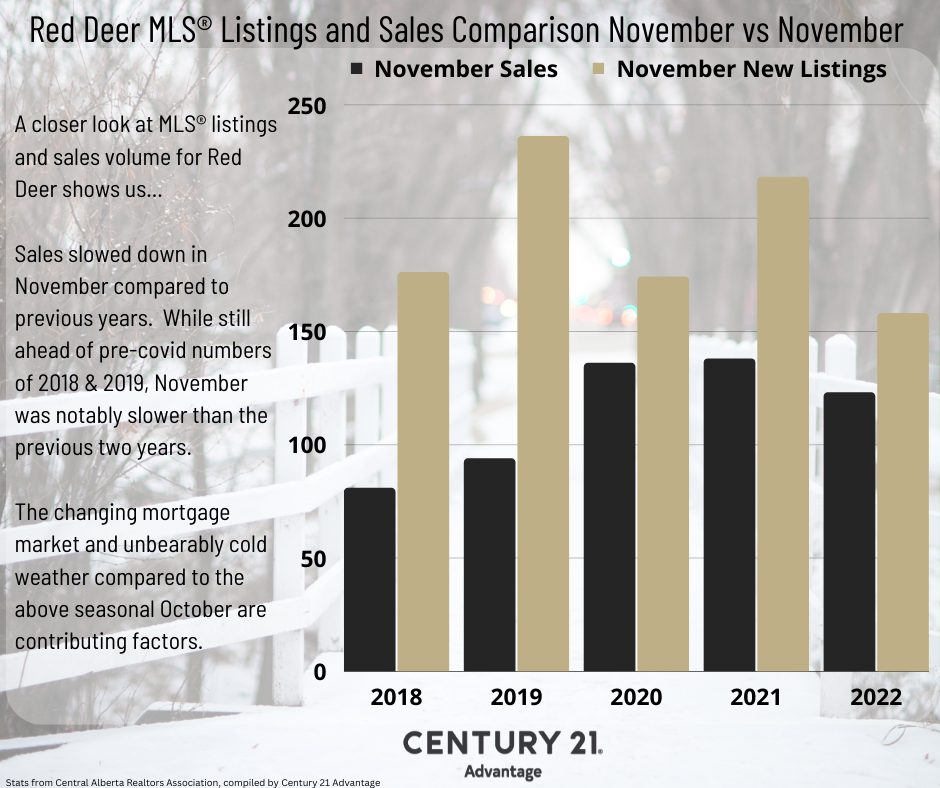

A closer look at MLS® listings and sales volume for Red Deer shows us...

Sales slowed down in November compared to previous years. While still ahead of pre-covid numbers of 2018 & 2019, November was notably slower than the previous two years.

The changing mortgage market and unbearably cold weather compared to the above seasonal October are contributing factors.

Bank Rate Increases and Their Impact on the Real Estate Market

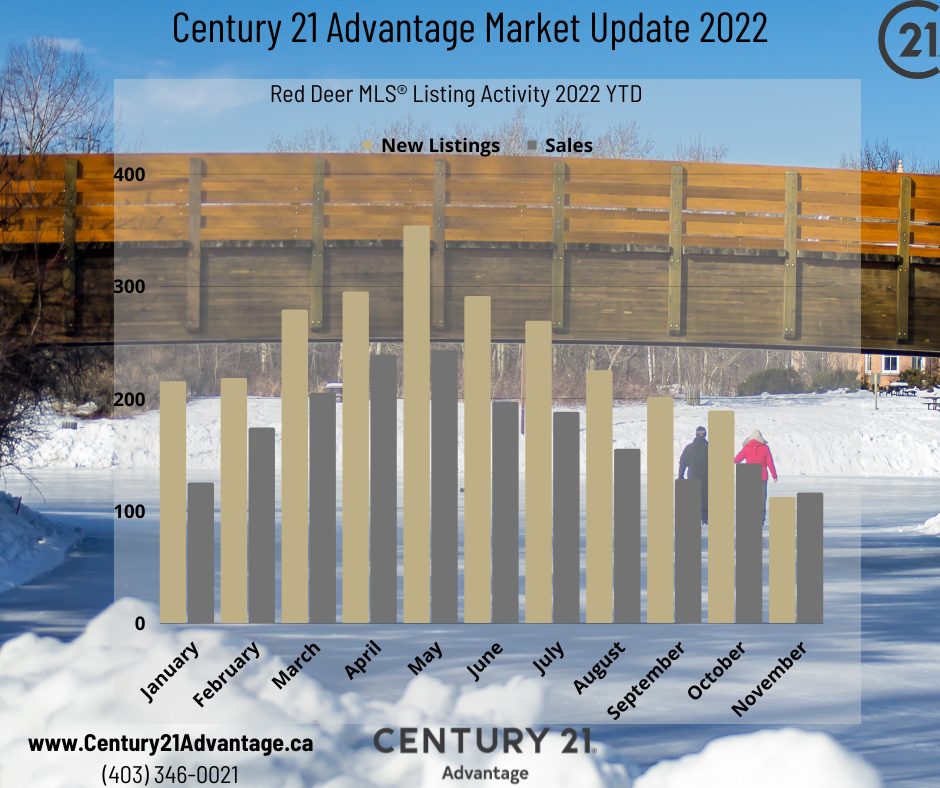

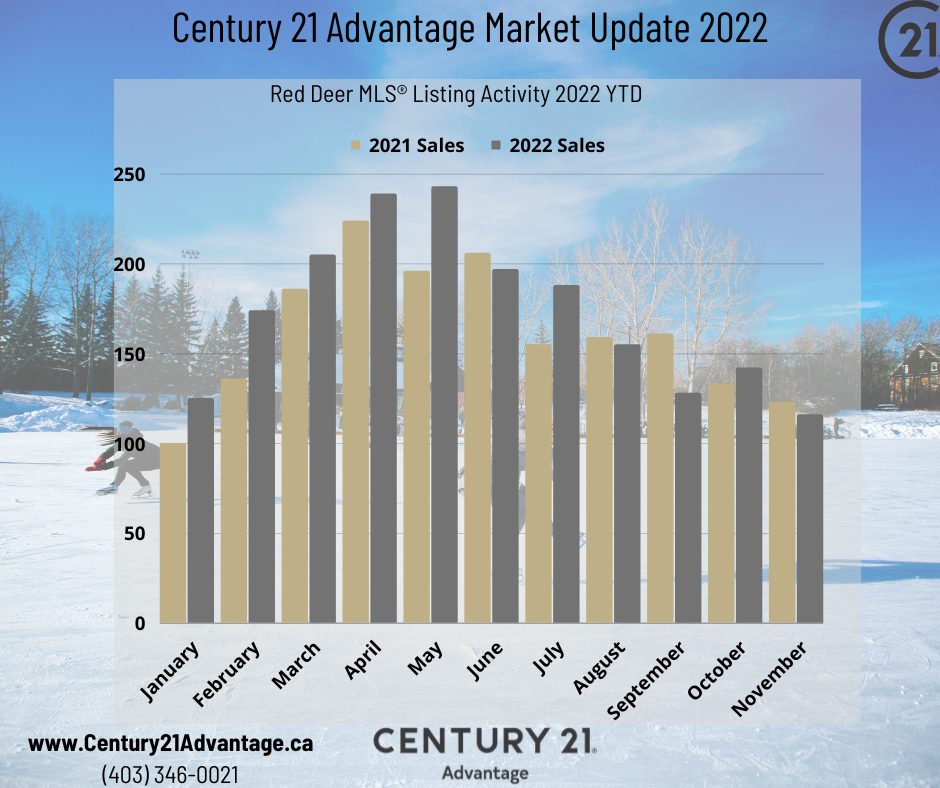

The seasonal trend for 2022 shows a strong spring market with sales and listing volume peaking in May. Do the results in the market reflect the interest rate increases announced by the Bank of Canada?

- April 13, 2022, The Bank of Canada increased its target for the overnight rate to 1%, with the Bank Rate at 1¼%. Effective April 25.

- On June 1, 2022, The Bank of Canada increased its target for the overnight rate to 1½%, with the Bank Rate at 1¾%.

- July 13, 2022, The Bank of Canada increased its target for the overnight rate to 2½%.

- September 7, 2022, The Bank of Canada increased its target for the overnight rate to 3¼%.

- On October 26, 2022, The Bank of Canada increased its target for the overnight rate to 3¾%.

- December 7, 2022, The Bank of Canada today increased its target for the overnight rate to 4¼%, with the Bank Rate at 4½%.

The next scheduled date for announcing the overnight rate target is January 25, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR at the same time.

The Bank of Canada's rate increases has certainly had an impact. You can see the rush of deals in May to take advantage of low rates, and the volume decline with each jump in rates.

We're expecting this change will have a cooling off and adoption of the new rates for budgets. The deciding factor has always been overall affordability compared to renting.

It's hard to believe that the last time rates were at this level was 2008/2009.

source: tradingeconomics.com